MyChoice serves as an independent intermediary between you, financial institutions and licensed professionals without any additional charge to our users. In the interest of transparency, we disclose that we partner with some of the providers we write about – we also list many financial services without any financial gain. MyChoice does not operate a financial institution or brokerage and to ensure accuracy, our content is reviewed by licensed professionals. Our unique position means that we hold no recurring stake in your policy, ensuring our mission to help Canadians make better financial decisions is free of bias or discrimination.

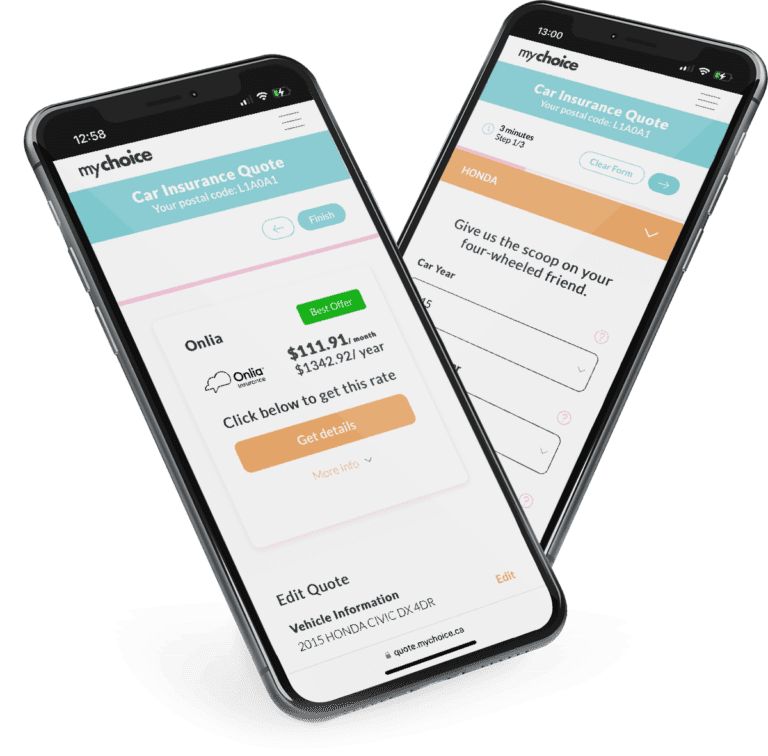

Comparing car insurance quotes with MyChoice is as simple as it gets:

Tell us what you want out of your auto insurance.

Compare auto insurance quotes from the best Canadian insurers.

Pick the best deal and lock your rates on our site.

| Monthly Premiums | Date & Time | Quote Type | Age | Gender | Postal Code |

|---|---|---|---|---|---|

| $91.65 | Apr 18, 2024, 01:20 AM | Auto | 68 | Female | N8W5N7 |

| $43.16 | Apr 18, 2024, 04:24 PM | Home | 37 | Female | L3Y8H4 |

| $19.59 | Apr 18, 2024, 07:21 AM | Tenant | 26 | Male | M5J2Y5 |

Canadians

Leah DJuly 19, 2023I was able to get a tenant insurance quote and a car insurance quote for my Jeep on the same day, in the same place, super fast and convenient, less than 10 mins! Would use again and would absolutely recommend

Leah DJuly 19, 2023I was able to get a tenant insurance quote and a car insurance quote for my Jeep on the same day, in the same place, super fast and convenient, less than 10 mins! Would use again and would absolutely recommend Imaan PiraniJuly 13, 2023Got a great quote for my Camry and to my surprise was able to purchase online... They passed all my information to the companies website automatically and it made the process a breeze!” Highly recommend

Imaan PiraniJuly 13, 2023Got a great quote for my Camry and to my surprise was able to purchase online... They passed all my information to the companies website automatically and it made the process a breeze!” Highly recommend David IfejikaJuly 13, 2023I was shopping around for car insurance and a friend suggested that I try MyChoice to help find the least expensive insurance for my partner and I. It was very reliable, straightforward and user friendly. It made finding new car insurance easy!”

David IfejikaJuly 13, 2023I was shopping around for car insurance and a friend suggested that I try MyChoice to help find the least expensive insurance for my partner and I. It was very reliable, straightforward and user friendly. It made finding new car insurance easy!” Ty WarnerJuly 12, 2023I was able to bundle my home and auto insurance with My Choice. Getting a quote for both was pretty quick, once I had done my auto portion I had the option to easily check my home insurance too so that was ideal!

Ty WarnerJuly 12, 2023I was able to bundle my home and auto insurance with My Choice. Getting a quote for both was pretty quick, once I had done my auto portion I had the option to easily check my home insurance too so that was ideal! John DoyleJuly 7, 2023Recently closed on a place in Markham and was able to get a great home insurance quote in minutes with MyChoice. Purchased online through square one right on closing day!

John DoyleJuly 7, 2023Recently closed on a place in Markham and was able to get a great home insurance quote in minutes with MyChoice. Purchased online through square one right on closing day! Tim BorgstädtJuly 4, 2023I don’t always shop around when it comes to my insurance but I’m glad I did this time, My Choice had a good range of options and I was able to chat to a broker once I found a quote that I liked!

Tim BorgstädtJuly 4, 2023I don’t always shop around when it comes to my insurance but I’m glad I did this time, My Choice had a good range of options and I was able to chat to a broker once I found a quote that I liked! Hao ShengJune 30, 2023I got a great quote from mychoice. Would definitely recommend everyone to start a quote. I got a much cheaper rate from CAA than my TD

Hao ShengJune 30, 2023I got a great quote from mychoice. Would definitely recommend everyone to start a quote. I got a much cheaper rate from CAA than my TD Leo BrasilJune 19, 2023Great experience getting an online quote, quick and easy. All things considered, it looks like I'm going to save around $80 a month on my car insurance!

Leo BrasilJune 19, 2023Great experience getting an online quote, quick and easy. All things considered, it looks like I'm going to save around $80 a month on my car insurance! Mark WhiteleyJune 19, 2023I was shopping around for home/auto insurance because my rates seemed to skyrocket on renewal. MyChoice allowed me to easily search for the most competitive rate, and next thing I know I'm saving $400 a year. Strongly recommend it!

Mark WhiteleyJune 19, 2023I was shopping around for home/auto insurance because my rates seemed to skyrocket on renewal. MyChoice allowed me to easily search for the most competitive rate, and next thing I know I'm saving $400 a year. Strongly recommend it!