How Can You Get Cheap Car Insurance in Markham?

You can get cheap Markham car insurance by finding the best deals. Here are several tips to help you do so:

Compare Rates Between Insurers

Markham has a highly competitive auto insurance market, so insurers are constantly vying for your business. When insurers try to give you the best deals, it’s you who wins. Compare rates and shop around to see which insurance provider fits your auto protection needs affordably.

Take Bundled Policies

One of the best ways to save money while shopping is to buy a package deal, and insurance is no different. If you bundle home and auto insurance from the same company, you’re much more likely to get lower rates.

Ask For A Higher Deductible

You must pay a deductible on insurance claims before your carrier covers the remaining expenses. A higher deductible means paying extra if something happens to your car, but it also means you’ll get lower insurance premiums.

Request Group Discounts

Many insurance companies deal in group discounts for companies and other organizations. If you’re shopping for auto insurance in Markham for work, ask your agent about group deals and discounts.

Pay Annual Premiums

Paying annual insurance premiums might look expensive initially, but it’s generally cheaper than paying them monthly. Ask your insurers about half-year premiums if you can’t afford annual premiums.

Drive Safely

Motor vehicle offences and accidents stay on your record for years. Unfortunately, any driving violation on your record will considerably increase your insurance rates. However, this also means you’ll get lower auto insurance rates if you have no offences on record.

Consider Taking Usage-Based Insurance

Usage-based insurance (UBI) or pay-as-you-go insurance tracks your driving behaviour to determine how much you must pay for insurance. Taking UBI lets you save up to 30% on your annual premiums, so it’s a good option if you consider yourself a safe driver.

Take Driving Courses

Accredited driving lessons make you a safer driver and let you earn discounts on auto insurance in Markham.

Choose the Coverage You Need

Naturally, more insurance protection leads to higher rates. While some auto insurance coverage is mandatory, you have optional insurance coverage like at-fault accident and theft protection. Review your policy and skip unnecessary optional coverage to save on insurance premiums.

Buy Affordable Cars

Cars that are expensive and hard to replace tend to get hit with higher premiums. If possible, buy affordable and reliable cars that are more common and easy to repair or replace if you want lower insurance rates.

Quick Facts About Auto Insurance in Markham

- Markham car insurance is MORE expensive than the Ontario average.

- The average annual car insurance cost in Markham for a driver with a clean record and comprehension/collision coverage is around $2,447.

- Comparing Markham auto insurance quotes with MyChoice can save you up to $1,738 annually.

Who Provides Car Insurance Quotes in Markham?

Insurance brokers, agents, aggregators, and direct writers provide car insurance quotes in Markham. Here’s an overview of these four insurance quote providers:

Insurance Brokers

Insurance brokers are independent professionals who help you shop for the best rates by comparing deals from multiple insurers. Because they have a bird’s-eye view of the current Markham insurance landscape, they can show you which companies offer the best insurance deals and answer any questions you may have.

Brokers take a commission from insurance companies, which could increase your rates. You might spend more money than if you had found an insurer yourself.

Direct Writers

Like insurance agents, direct writers only sell insurance products from one company. Direct writers are typically found online and are cheaper because they don’t have physical offices.

Insurance Agents

Insurance agents work for a certain insurer, so they can only offer their employer’s insurance products. However, they know their insurer like the back of their hands and might even give you discounts that brokers don’t have access to.

Additionally, insurance agents can close insurance sales independently, meaning you can purchase insurance from them right then and there.

Insurance Aggregators

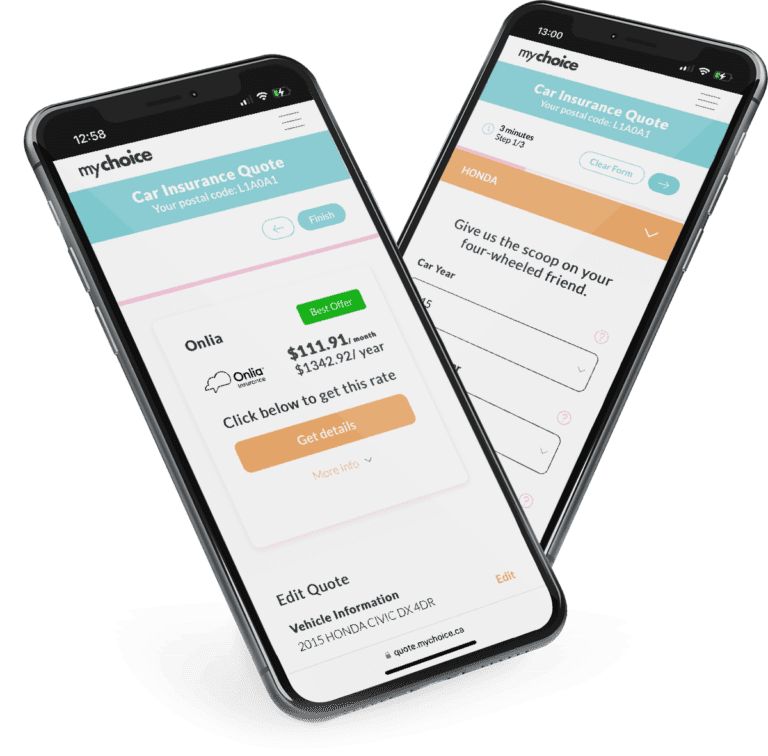

An insurance aggregator website like MyChoice compiles rates from various insurance brokers, companies, and direct writers in one place. You can browse aggregator websites to find the best deals from the top insurance companies and get quotes instantly.

Better yet, insurance aggregators are accessible online and entirely free for customers, so you can look up insurance rates without spending a single penny or leaving the house.

How Does Car Insurance Work in Markham?

Car insurance in Markham works by providing financial coverage in case something bad happens to you or your car, depending on the protection you choose. Auto insurance in Markham is mandatory by local laws, which means you need car insurance to avoid fines or driver’s licence suspensions.

Worse still, if you get convicted of driving without insurance, you’ll get higher premiums from carriers. This makes driving again prohibitively expensive or even nearly impossible after being caught driving without insurance. That’s why getting auto insurance is essential before buying a car or driving in Markham.

Here’s a breakdown of the key elements of your auto insurance policy:

The mandatory car insurance requirement for Markham drivers are:

Third-Party Liability (TPL) Coverage

This insurance component provides financial compensation if you cause an accident that results in car damage or somebody getting hurt or killed. Per Financial Services Commission of Ontario (FSCO) regulations, you need at least $200,000 in TPL coverage.

Statutory Accident Benefits Coverage

This insurance component pays for your medical bills, rehabilitation, and possible funeral expenses if you get hurt or killed in a car accident, regardless of who’s at fault. Accident benefits coverage also offers income replacement worth 70% of your gross income, capped at $400 per week.

Uninsured Automobile Insurance

Uninsured automobile insurance covers your medical bills and funeral expenses if you’re struck by uninsured vehicles or hit-and-run drivers. Additionally, it compensates for vehicular damage caused by uninsured drivers.

Direct Compensation – Property Damage (DC-PD) Insurance

DC-PD insurance compensates you for the damage other drivers cause in an accident. However, DC-PD only kicks in if the other person is at fault, they’re also insured, and the accident takes place in Markham.

Once you meet the minimum car insurance coverage requirements, you can legally drive in Markham. However, it pays to have extra protection beyond the basics in case you get in an accident.

Since minimum car insurance only goes so far, we’ve got some extra Markham car insurance recommendations for you:

Extra TPL Coverage

The mandatory $200,000 insurance minimum can be too small, so many drivers choose to get coverage up to $2 million if they cause property damage or hurt somebody in an accident.

Additional Statutory Accident Benefits

Many people get additional coverage for medical bills and funeral expenses in their statutory accident coverage. You can also get extra income replacement protection if 70% income capped at $400 a week seems too limited.

More Comprehensive Property Damage Protection

DC-PD coverage has very specific coverage terms like the other driver also needs to be insured, and the accident must occur in Markham. To cover their bases, many people purchase extra insurance that still protects them even when the other driver is uninsured, and the accident happens in other provinces.

In addition to mandatory insurance coverage outlined by the FSCO, you can take optional insurance coverage like:

Specified Perils Protection

Specified perils insurance coverage protects you from loss or damage due to a specific cause. The most common perils insured are:

- Car theft

- Fire, earthquake, and explosion

- Weather, which includes windstorms, hail, and lightning

Many insurers also offer comprehensive auto insurance in Markham if you want protection from all these perils.

Accident Forgiveness

Insurers usually raise your premiums if you’re at fault for causing an accident. If you’ve been a safe driver for several years, you can take extra accident forgiveness coverage so you won’t get higher premiums if you cause an accident. Note that accident forgiveness only works on your first accident, and subsequent violations will still raise your rates.

Limited Depreciation Waiver

If you take a limited waiver of depreciation, you can receive your car’s purchase price as compensation if it’s been stolen or deemed a total loss after an accident.

How Your Car Insurance Quotes Are Calculated in Markham

Your car insurance rates are calculated based on how risky you are to insure. Naturally, drivers more likely to get into accidents will have higher premiums than those less likely to be in an accident.

Here are seven factors that influence your Markham car insurance quotes:

Age, Gender, and Marital Status

Your personal demographics influence auto insurance premiums in Markham because different people have varying accident risks.

Younger people tend to get higher premiums because insurance companies see them as more accident-prone than older people. Generally, your car insurance rates start decreasing when you hit 25 years old as long as you keep a safe driving record. However, insurance premiums increase again for people aged 65 and older because they’re more likely to be injured or killed in traffic accidents.

Women often get lower insurance rates because they’re seen as more careful drivers and don’t take as many risks as men.

Marital status also determines your rates because most insurance companies see married people as more financially stable and less-risky drivers. Married couples also tend to bundle home and auto insurance, saving more on premiums.

Location

People who live in urban areas often see higher insurance premiums because they’re more prone to car accidents and theft.

Car Make and Model

Expensive cars are more costly to repair or replace, so insurance premiums are usually higher than more common vehicles. You can install security features like anti-theft devices if you have an expensive car and want to save on insurance premiums.

Driving History

People who drive safely are rewarded with lower premiums because they’re usually less likely to get into a traffic accident. Conversely, people who have gotten into multiple accidents get higher premiums because they’re more likely to be involved in another accident down the line.

Driving Activity

Logic dictates that people who drive frequently are more likely to get in an accident. Therefore, kilometres driven is one of the determining factors that set your Markham auto insurance rates.

Insurance Coverage Chosen

Your coverage options influence your insurance rates because taking more coverage gives you more protection. Naturally, the more coverage you choose, the higher your rates.

Policy Discounts

Getting discounts can lower your auto insurance rates and make them more affordable. You can typically get discounts by bundling home and auto insurance or asking for a group discount for your workplace or organization.

Most Expensive Postal Codes in Markham

Markham has higher-than-average car insurance rates due to its sizable population and its close proximity to Toronto. Markham’s average auto insurance rate is $2,447, around $800 over the Ontario average. The postal code with the most expensive insurance rates is L3S, which includes Box Grove and Vinegar Hill.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L3S | $2,570 |

| L3R | $2,565 |

| L3P | $2,562 |

Least Expensive Postal Codes in Markham

The Markham postal code with the most affordable auto insurance rates is L6C, which includes Downtown Markham and Highways 7 and 8.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L6C | $2,351 |

| L6E | $2,356 |

| L6G | $2,358 |

Car Insurance Cost in Markham by Age

Younger drivers are more likely to receive higher insurance premiums because their lack of experience makes them more likely to get into an accident. The good news is that younger drivers can lower insurance premiums by taking certified driving lessons, applying for student discounts, or riding on their parents’ insurance policies as secondary drivers.

While insurance rates tend to drop for drivers by the time they hit 35, they rise after 65 as older drivers are more likely to sustain significant injuries in an accident.

Take a closer look below at how age can directly impact your insurance premiums:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $8,736 | $1,738 |

| 21-24 | $4,992 | $993 |

| 25-34 | $3,228 | $662 |

| 35-44 | $2,447 | $487 |

| 45-54 | $2,007 | $399 |

| 55-64 | $1,706 | $339 |

| 65+ | $1,944 | $387 |

Car Insurance Cost in Markham by Driving History

While you can qualify for auto insurance even with a bad driving history, a record of accidents and collisions can significantly increase your rates. One speeding ticket isn’t going to increase your premiums drastically, but repeated offences can.

Here’s a closer look at how driving violations can impact your insurance rates:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $2,447 |

| Insurance cancellation due to non-payment | $4,013 |

| Licence suspension for alcohol-related offences | $2,936 |

| One accident | $5,383 |

| Speeding ticket | $3,181 |

Other Factors That Affect Car Insurance Prices in Markham

We’ve covered several factors that influence car insurance rates in Markham. Aside from those, several extra factors play a part in determining your Markham auto insurance premiums:

Vehicle Model Accident Rates

Some cars are just more accident-prone than others. Even if you have a spotless driving record, owning a car model infamous for having high accident rates will increase your insurance premiums.

Vehicle Age

Naturally, older cars are more expensive to insure because they may not have all the safety features of newer vehicles. If you insist on driving a vintage car everywhere, make sure you can pay the insurance premiums.

Vehicle Repair Costs

The harder it is to repair a car, the more expensive it is to insure. You can expect high insurance premiums on luxury cars and foreign cars that don’t have a large dealership or service centre presence in Canada.

Vehicle Primary Usage and Annual Mileage

You may spend more or less time on the road depending on what you use the car for. Car usage influences insurance rates – generally, the more you use it, the higher your premiums. For instance, insurance premiums on a car you use as an Uber will be higher than on a car you almost exclusively take on weekend cruises.

A good way to measure how much somebody uses a car is by its annual mileage. If your car has low annual mileage, insurers may determine that this car is low-risk and thus grant you more affordable insurance rates.

Local Crime Rates

Living in high-crime areas means your car is at higher risk of being stolen or vandalized. If you live in an area where theft or vandalism often occurs, you may get higher car insurance rates.

Past Insurance Claims

Any auto insurance claims will drive your premiums up, regardless of who’s at fault. If you make many insurance claims, the insurer will see you as a high-risk policyholder and give you higher rates.

Loyalty Bonuses

Many insurance companies reward long-term customers with discounted rates. If you’ve been a policyholder at the same insurance company for several years, ask for a rate reduction or discount when you renew your policy.

The Best Car Insurance Brokerages in Markham

Car insurance brokers help you shop for the appropriate rates. By providing them with the necessary information, you can review different insurance levels suitable for your vehicle, history, and driving habits.

Below are a few of the best brokerages in the region:

| Brokerage | Address | Phone number |

|---|---|---|

| Guthrie Insurance Brokers & INSUREPLUS | 1151 Denison St Unit 19 Markham, ON L3R 3Y4, Canada | +14164875200 |

| ThinkInsure | 11 Allstate Pkwy unit 206 Markham, ON L3R 9T8, Canada | +18555505515 |

| Sukhu Insurance Brokers | 22-7595 Markham Rd Markham, ON L3S 0B6, Canada | +19055542020 |

| Billyard Insurance Group – Markham North | 9889 Markham Rd Unit 202 Markham, ON L6E 0B7, Canada | +18885086118 |

Driving in Markham

Markham is prone to long construction hours, so expect road congestion and a lot of time stuck in traffic. When driving around the city, you’ll want to keep these key facts in mind:

- Major highways: Highway 404, Highway 7

- Public transit options: York Regional Transit, Go Transit

- Ridesharing services: Uber

- Parking space providers: City of Markham, Impark

- Top tourist attractions: Pacific Mall, Toogood Park, Rouge National Urban Park, Milne Dam Conservation Park, Reesor Farm Market

- Busy intersections: Woodbine Ave to Highway 7, Woodbine Ave to Steelcase Road, Highway 7 to Warden Ave, Highway 7 to McCowan Road, Kennedy Road to 14th Avenue

- Airports: Buttonville Municipal Airport

Main Mode of Commuting in Markham

Out of 89,280 Markham commuters, 77,820 of them travel by car, truck, and van. Most of Markham’s car commuters drive themselves, but around 7,300 of them are passengers. Check the table for more details on how people commute in Markham:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 89,280 | 100.0 |

| Car, truck or van | 77,820 | 87.2% |

| Car, truck or van – as a driver | 70,505 | 79.0% |

| Car, truck or van – as a passenger | 7,315 | 8.2% |

| Public transit | 6,970 | 7.8% |

| Walked | 2,095 | 2.3% |

| Bicycle | 300 | 0.3% |

| Other method | 2,095 | 2.3% |

Commuting Duration in Markham

Markham is one of the most congested municipalities in York, and you can see it in its commuting duration. Around 60% of Markham’s commuters spend 15 to 44 minutes on the road each day. Only roughly 15,000 people out of 89,280 commuters spend under 15 minutes commuting. Here’s a closer look at the commuting duration in Markham:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 89,280 | 100.0 |

| Less than 15 minutes | 15,220 | 17.0% |

| 15 to 29 minutes | 30,635 | 34.3% |

| 30 to 44 minutes | 24,575 | 27.5% |

| 45 to 59 minutes | 9,200 | 10.3% |

| 60 minutes and over | 9,650 | 10.8% |

Driving Conditions in Markham

While Markham summers are warm, winters can be snowy and windy, factors that can make it challenging to drive carefully. Keep these facts about driving conditions in Markham in mind when behind the wheel:

- Average daily commute time: 60 minutes round trip

- Average annual rainfall: 82 mm

- Average annual snowfall: 96.52 mm

- Rainy days per year: 45 days

- Rainiest month in Markham: June

- Driest month in Markham: March

- Snow days per year: 51 days

- Snowfall months in London: November – April

Traffic in Markham

Markham is the largest and most congested municipality in the York Region, so expect traffic to be bad year-round. The best way to avoid potential accidents is to keep from driving during congestion hours and to track construction using an app.

Here are a few other things you should know about traffic in Markham.

- Population: Markham has a population of 360,000 people.

- City area: The Markham city limits span 210.9km2.

- Busiest highways: The busiest highways in Markham include Highway 7 and Highway 404.

- Average number of distracted driving: Roughly 333 drivers receive charges for impaired driving per year.

The Most Common Questions About Car Insurance in Markham

Is ridesharing insurance available in Markham?

Yes, ridesharing insurance is available in Markham for Uber and Turo.

How much does Markham car insurance cost?

Markham car insurance costs roughly $2,447 a year.

Is car insurance cheaper in Markham than in Toronto?

No, car insurance is not cheaper in Markham than in Toronto. In fact, it is about $300 above the Toronto average of $2,139.

Who has the cheapest auto insurance in Markham?

You can find the cheapest auto insurance in Markham by comparing quotes through the MyChoice calculator. We help you find the best possible rate from different providers.

Why should you compare car insurance rates in Markham?

You should compare car insurance rates in Marham to get the best possible price. No two providers offer the same rates, so shopping around can help you find an affordable plan.

How do you find affordable car insurance for students in Markham, Ontario?

To find affordable car insurance for students in Markham, shop around for new driver discounts. Students can also bring their insurance rates down by taking a driver’s education course or listing themselves as a secondary driver on a parent’s insurance plan.

Which auto insurance is best for young drivers in Markham?

The auto insurance that is best for young drivers in Markham will depend on the type of coverage you need. Be sure to shop around for the best rates and compare policies with an experienced driver.