Truck Insurance: Finding What’s Right For You

Trucks are a popular type of vehicle in Canada with them dominating the automotive market. The Ford F series is the most popular vehicle in the country with it selling nearly eighty thousand vehicles in 2017. Other popular trucks include the Ram Pickup and the GMC Sierra. Interestingly, trucks and SUVs make up seven out of the ten top-selling vehicles for the Canadian market.

Trucks can be used in a range of different ways and as a result can be considered quite versatile, which has led to consumers searching for the best way to get the most out of their insurance for trucks.

What’s Your Average Typical Insurance For A Truck

It can be difficult to determine the average cost of insuring a truck vs. a car. This is because a variety of factors affect car insurance rates such as danger to the occupants/driver and risk associated with driving a truck.

A truck is heavier than other vehicles and so a truck is usually considered quite safe for the occupants in comparison to a car. However, the heaviness of a truck means that it is more likely to cause property damage to other things in the event of a crash.

Is Truck Insurance Different From Car Insurance?

Truck and car insurance are not different, so you will not need to purchase an insurance policy specifically for a truck. Instead, you will simply purchase general personal auto insurance. There are a number of similar features across the two, including:

- Accident Benefits

- Collision Benefits

- Comprehensive Benefits

- Third-Party Liability

Accident Benefits

Accident benefits are designed to protect you following a car accident generally, it will cover a number of medical and personal expenses like loss of income or rehabilitation costs.

Collision Benefits

Collision benefits are designed to cover the cost of repairing or replacing your vehicle following an accident with another vehicle or object on the road.

Comprehensive Coverage

Comprehensive coverage is designed to protect your vehicle from a variety of damages. This can include such things as theft, vandalism or an uninsured driver.

Third-Party Liability

Third-party liability is designed to cover you if you happen to harm another person while driving. This insurance is required for all Canadian drivers and is designed to cover you from liabilities such as injuring another person or their vehicle.

How To Know If Your Vehicle Is Considered A Truck

A truck is usually considered a personal vehicle with it falling under the category of general auto insurance.

A truck is commonly defined as a vehicle that has key features designed for carrying cargo. This means that it features a body-on-frame construction as opposed to most modern cars that have a traditional frame. Instead, cars such as sedans have the frame built into the vehicle. The body on vehicles like trucks and SUV’s mean that they can be heavier and carry much more weight than a car.

Commercial Truck Insurance

There is a difference between truck and car insurance when considering large trucks such as a semi or box truck. These vehicles will require a commercial form of insurance that is specific for large vehicles. However, vehicles that you use for personal requirements only will not need this.

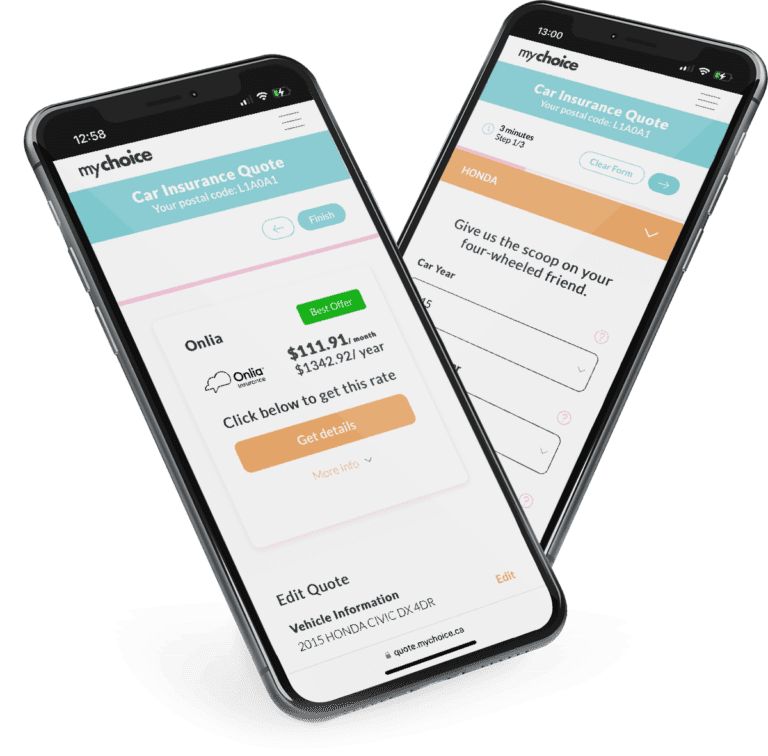

Finding The Perfect Truck Insurance With MyChoice

The most important aspect of finding the perfect insurance is to shop around. This will allow you to make sure that you get an insurance policy that has the coverage you want, and will offer you the lowest rates possible.

You can compare insurance from a range of top providers with MyChoice. We only require you to enter information such as your age, how much you drive, and if you have ever filed a claim.

You will also need to enter in information about your vehicle. MyChoice allows you to put in specific information about your truck. You can enter in its specific model such as if it is a four wheel drive, extended cab, or a long-bed which allow you to get the most accurate insurance quotes possible.